10 Feb, 2026

Mission 6 Development Begins, JAXA’s Pinpoint Landing Technology to Be Utilized in the Private Sector, Revised Earnings Forecast While Earnings Power Remains Unchanged

TOKYO—February 10, 2026—ispace, inc. (ispace) (TOKYO: 9348), a global lunar exploration company, today announced its financial results for the third quarter of the fiscal year ending March 2026.

As part of the quarterly financial report, ispace reported on business highlights, primarily covering the development progress of Mission 6. Additionally, ispace was selected for the Japanese Government’s Space Strategy Fund second phase to implement the project, “High Precision Landing Technology in Lunar Polar Regions” overseen by the Japan Aerospace Exploration Agency (JAXA). ispace will utilize pinpoint landing technology demonstrated by JAXA’s SLIM (Smart Lander for Investigating Moon), integrate it into future landers, and aim to commercially utilize the technology.

During the quarter, research achievements were recognized by the European Space Agency (ESA) for Phase 1 of the MAGPIE (Mission for Advanced Geophysics and Polar Ice Exploration) project with a budget of up to $76 million USD announced for the subsequent demonstration phase.

As part of the company’s quarterly reporting, ispace has utilized “project revenue,” which combines accounting revenue with subsidy income included in non-operating income, as a figure demonstrating the company’s fundamental strength. The forecast for project revenue for the fiscal year ending March 2026 has now been revised from the initial projection of approximately ¥10 billion to ¥6 billion, a reduction of about 40 percent. Most of this revenue reduction stems from income from already signed contracts being deferred to subsequent fiscal years. This is not a typical “revenue decline” caused by contract loss or reduced demand and therefore does not affect the company’s total contract value, which represents its earning power. The deferral is the result of development of the new engine, planned for use in both Missions 3 and 4, which is taking longer than initially planned. Please refer to the financial results presentation materials for details.

Statement of Jumpei Nozaki, CFO & Executive Business Director of ispace

“We are extremely pleased that ispace was selected for Japan’s Space Strategy Fund second phase project, ‘High-Precision Landing Technology in Lunar Regions,’ and that Mission 6 development has begun. These have illuminated the path toward the mass production phase for our lunar landers. Regarding the revision to our project revenue-based performance outlook, most of the revenue reduction factors are merely deferred to the next fiscal year and beyond. The total contract value, which represents our company’s earning power, remains unchanged,” said Jumpei Nozaki, CFO & Executive Business Director, ispace, inc.

For details, please refer to the Financial Results for the Third Quarter of the Fiscal Year Ending March 2026 [Japanese GAAP] (Consolidated) document released today on ispace’s IR site. Additionally, the financial results presentation materials, recorded financial results briefing, and transcript of the financial results briefing will be available on the site.

IR site: https://ir.ispace-inc.com/jpn/news/

Overview

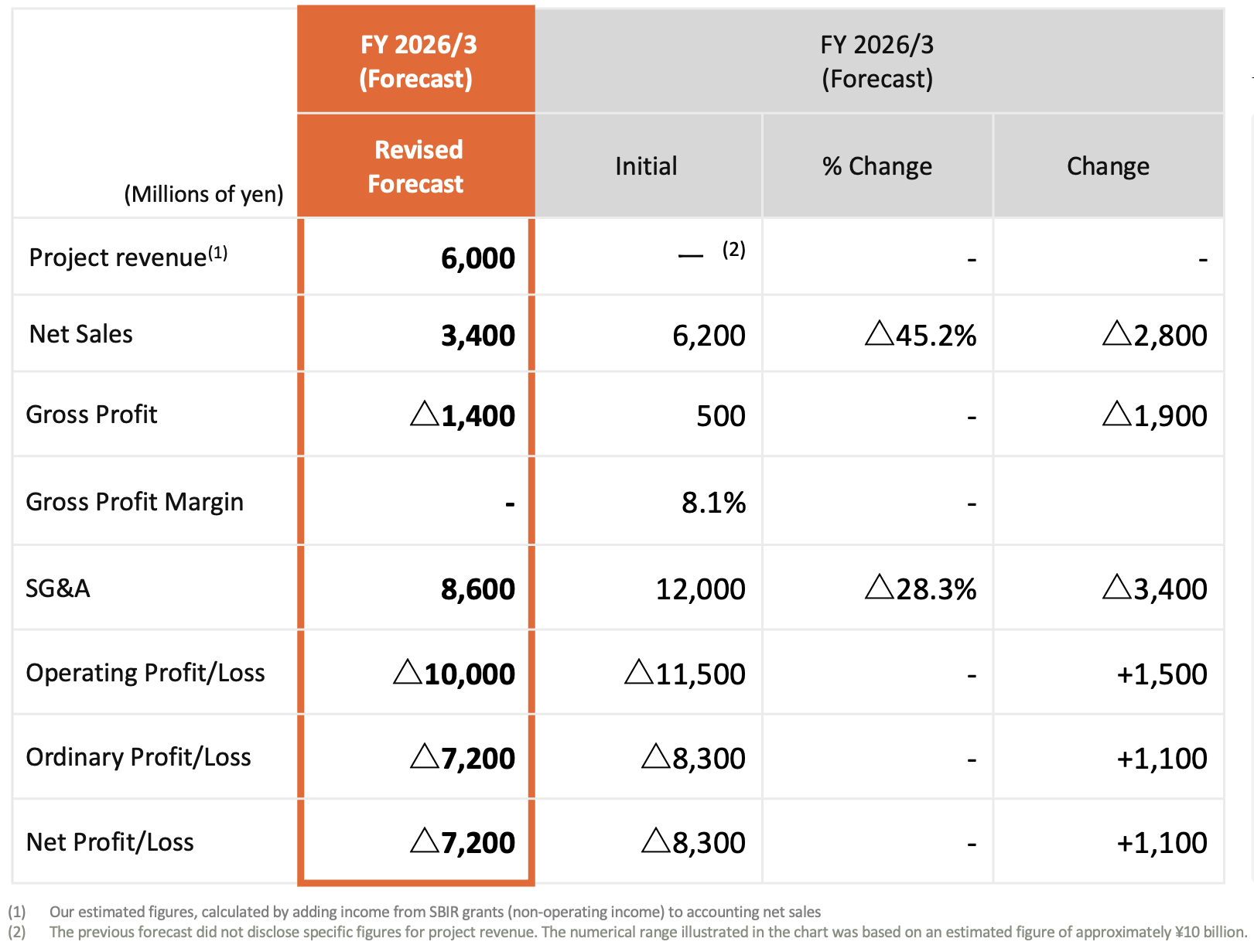

1. Revision of Financial Forecast

- Project Revenue: 6 billion yen

Revenue is expected to decrease primarily due to a shortfall in deferred revenue for Mission 3, caused by delayed customer payments beyond initial projections, and for Mission 4, due to a delay in receiving the SBIR grant.

- Net sales: 3,400 million yen

Net sales are expected to decrease primarily due to Mission 3, as deferred revenue is falling short due to customer payments being delayed.

- Gross profit: -1,400 million yen

Due to insufficient deferred revenue in Missions 3 and 4, costs will be recorded but revenue will not be recognized, resulting in an expected deficit.

- Operating profit/loss: -10,000 million yen

The deficit is expected to narrow primarily due to delayed expenditures related to engine development delays in Missions 3 and 4, as well as the impact of deferring some development costs on a flexible basis.

- Net Profit/loss: -7,200 million yen

Although SBIR grant income (non-operating income) decreased due to delays in Mission 4 development costs, the loss margin is expected to improve due to factors such as foreign exchange gains.

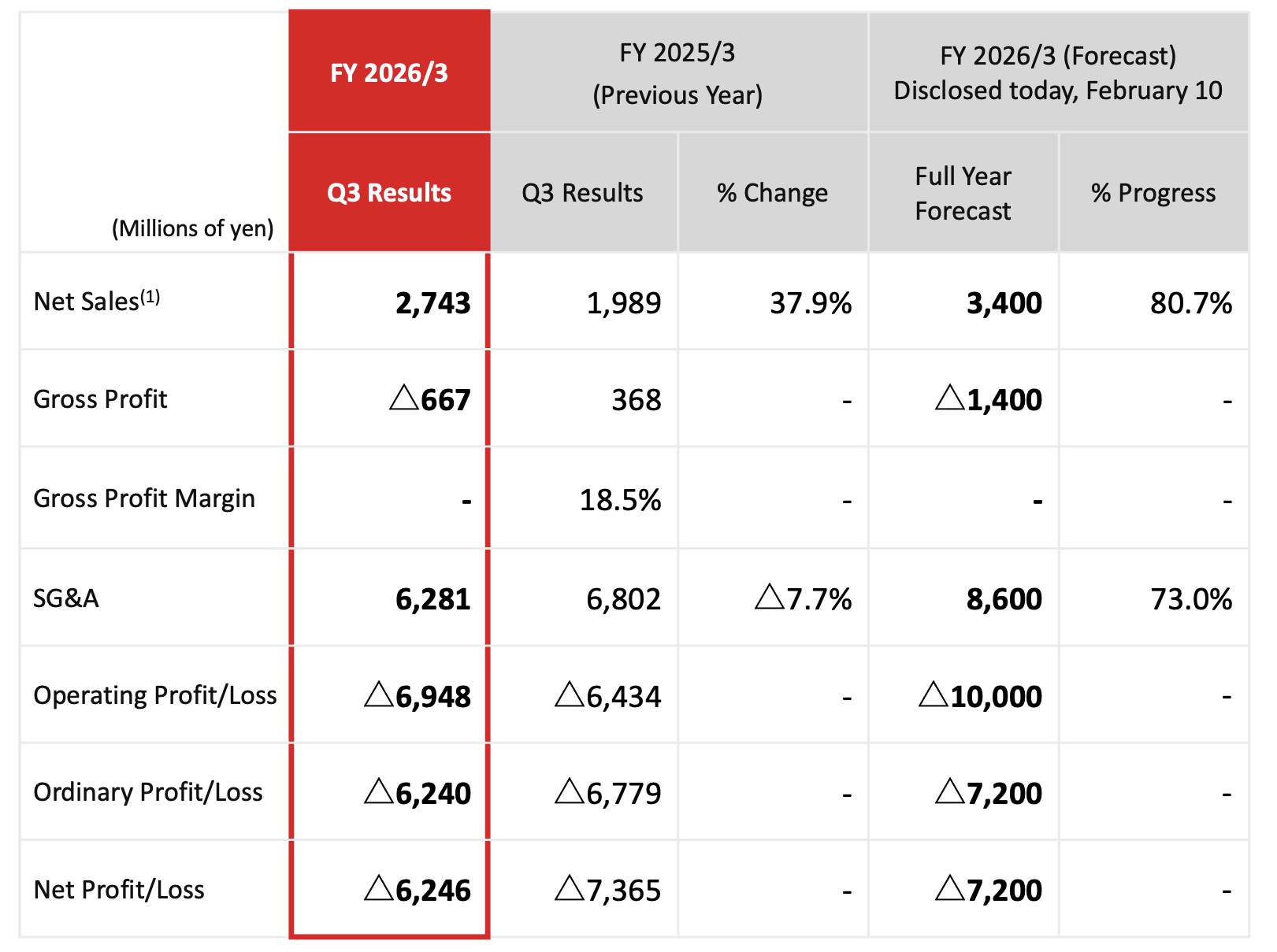

Q3 Financial Results for the Fiscal Year Ending March 2026

2. Operating Results

- Net Sales: 2,743 million yen

Net Sales increased year-on-year (YoY) due to progress in Mission 3 development, but revenue recognition delays related to Mission 3 occurred in the third quarter.

- Operating Profit/Loss: -6,948 million yen

As described above, the delay in revenue recognition and the cost recognition for Mission 4 resulted in gross profit loss, leading to an increase in the operating loss compared to the previous year.

- Net Profit/Loss: -6,246 million yen

Net loss was ¥6.2 billion, narrowing year-on-year, primarily due to the impact of foreign exchange gains recorded in the third quarter. In Q4, the portion of SBIR grant income related to Mission 4 received this fiscal year is scheduled to be recognized in a lump sum.

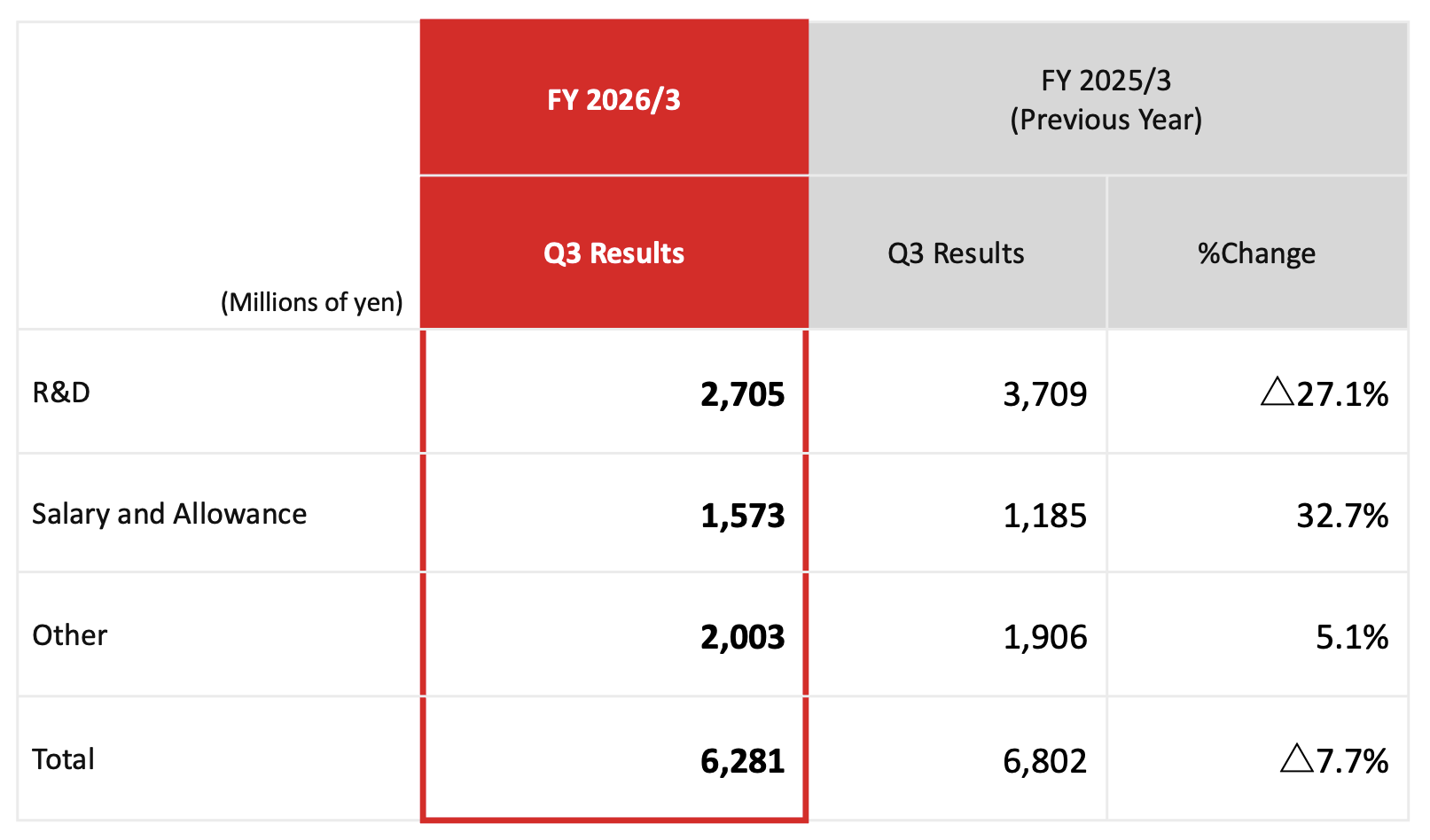

Q3 Financial Results for the Fiscal Year Ending March 2026

Q3 Financial Results for the Fiscal Year Ending March 2026

- Research and development expenses: 2,705 million yen

The shift from Mission 2 development, a primarily R&D mission, to Mission 4 development, early phase commercialization, within the Japanese entity, resulted in a shift from primarily R&D expense recognition to recognition under costs of goods and services. Consequently, the R&D expense figure decreased year-on-year.

- Salaries and allowances: 1,573 million yen

This increased by 32.7% year-on-year, proportional to the increase in the total number of employees across the Group (+31 employees compared to the same period last year).

- Other: 2,003 million yen

Expenses for the third quarter decreased year-on-year, resulting in cumulative expenses remaining flat compared to the same period last year.

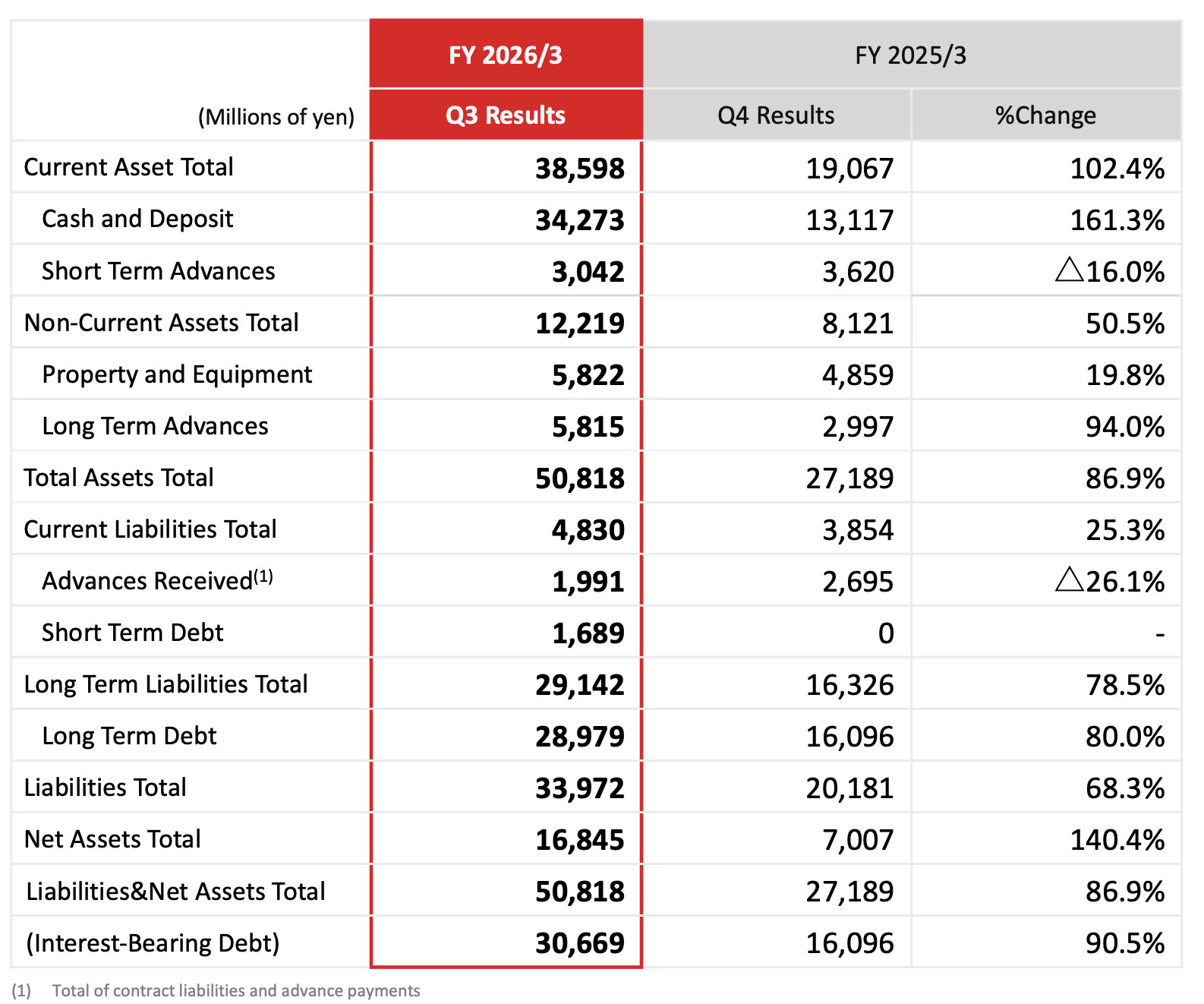

Q3 Financial Results for the Fiscal Year Ending March 2026

Q3 Financial Results for the Fiscal Year Ending March 2026

- Assets: 50,818 million yen

- Cash and Deposit: 34.2 billion yean

Cash and deposits reached ¥34.2 billion, primarily due to the effects of the ¥18.2 billion public offering and third-party allotment of shares conducted mainly from October to November 2025, ensuring stable liquidity on hand.

Advance Payments: Increased compared to the previous fiscal year-end, mainly due to procurement of components for Mission 3 and Mission 4.

- Liabilities: 33,972 million yen

Interest-bearing debt increased compared to the previous fiscal year-end due to borrowing executed in May 2025.

- Net assets: 16,845 million yean

Increased compared to the previous fiscal year-end due to the ¥18.2 billion capital increase, establishing a stable financial foundation.

About ispace, inc. (https://ispace-inc.com)

ispace, a global lunar resource development company with the vision, “Expand our planet. Expand our future.”, specializes in designing and building lunar landers and rovers. ispace aims to extend the sphere of human life into space and create a sustainable world by providing high-frequency, low-cost transportation services to the Moon. The company has business entities in Japan, Luxembourg, and the United States with more than 300 employees worldwide. For more information, visit: www.ispace-inc.com and follow us on X: @ispace_inc.